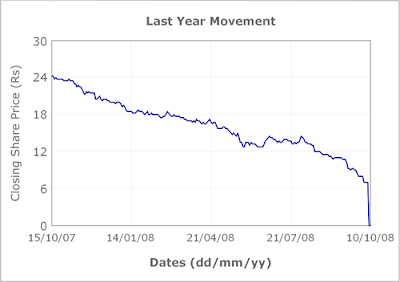

Sri Lanka’s telecom giant and once most profitable corporate Dialog Telekom’s share price yesterday slipped to its all time low of Rs. 7.75 including an intra-day lowest of Rs. 7.50, but the Company has ruled out a share buy back deal.

Dialog Telekom CEO Dr. Hans Wijesuriya in comments to Reuters yesterday had said there were no plans to buy- back shares to try to boost the price from an all-time low.

Dialog share price has dropped 40% since Aug. 13, when the company announced a 78% fall in quarterly profits. “Movement of the share price is certainly a result of multiple market dynamics and the company does not intend to influence those,” Wijesuriya said, referring to market speculation about a share buyback. High interest rates, high inflation and a global credit crunch have also contributed to the share’s fall, as well as squeezed profit margins, Wijesuriya said.

Despite a sour bottom line, Dialog remains the undisputed leader. Last week it announced a key milestone of 5 million plus customer base, growing 17.4 percent in January-September. “Usage is growing, but at a rate which is a little lower than last year. With the economic conditions, plus competition, there is pressure on margins. I think it’s short-term.” Sri Lanka’s annual inflation hit a 6-year high last month, and Dialog slashed call charges twice last year and once this year to spur usage. “We need to continue to grow in order to support the usage need and the coverage need. There will be a requirement for investment in coverage, in capacity as well as in technology advancement,” Wijesuriya told Reuters.

1 comment:

aney pawww dialog..

Airtel enga kalinma share bahalaa...

Post a Comment